The Duty of Offshore Finance Centres in Global Tax Preparation

The Duty of Offshore Finance Centres in Global Tax Preparation

Blog Article

The Impact of Offshore Financing Centres on International Service Procedures and Compliance

Offshore Financing Centres (OFCs) have come to be essential in forming worldwide business operations, supplying unique advantages such as tax obligation optimization and regulative versatility. The boosting worldwide emphasis on compliance and transparency has actually introduced a complicated array of challenges for services seeking to leverage these centres.

Comprehending Offshore Financing Centres

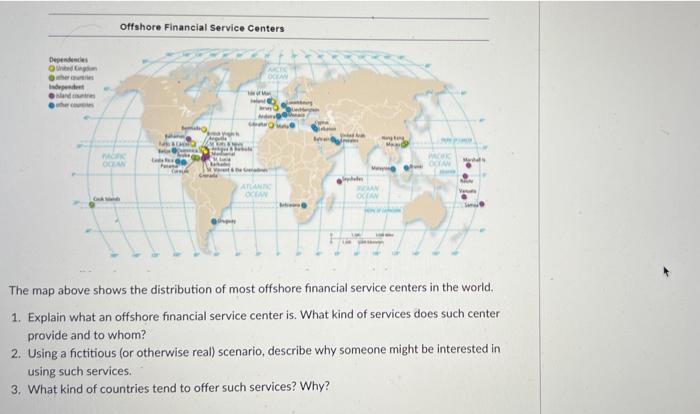

Offshore finance centres (OFCs) function as pivotal hubs in the worldwide financial landscape, helping with international business deals and investment chances. These territories, commonly identified by beneficial regulatory atmospheres, tax rewards, and discretion legislations, draw in a diverse selection of economic services, including insurance policy, banking, and financial investment management. OFCs make it possible for organizations to enhance their economic procedures, manage risk more successfully, and attain better versatility in their monetary techniques.

Typically situated in regions with low or no taxation, such as the Caribbean, the Channel Islands, and certain Oriental regions, OFCs offer a lawful framework that permits firms to run with loved one ease. They usually have robust financial frameworks and a solid emphasis on privacy, which interest international firms and high-net-worth people looking for to shield their properties and get accessibility to international markets.

The operational frameworks of OFCs can differ dramatically, affected by regional guidelines and international compliance standards. Comprehending the distinct features of these centres is essential for services aiming to browse the intricacies of worldwide money (offshore finance centres). As the international financial landscape develops, OFCs continue to play a considerable role fit the techniques of businesses operating across borders

Advantages of Utilizing OFCs

Making use of offshore financing centres (OFCs) can dramatically boost a firm's financial efficiency, particularly when it pertains to tax optimization and governing flexibility. One of the primary benefits of OFCs is their capability to use favorable tax programs, which can cause significant savings on corporate tax obligations, funding gains, and estate tax. By purposefully designating earnings to territories with reduced tax obligation prices, business can improve their overall monetary performance.

Moreover, OFCs commonly present structured governing settings. This reduced administrative concern can assist in quicker decision-making and more active organization procedures, permitting firms to react promptly to market adjustments. The regulatory structures in several OFCs are developed to bring in international investment, providing services with a conducive setting for growth and growth.

Furthermore, OFCs can act as a calculated base for worldwide operations, making it possible for business to access global markets much more efficiently. Boosted confidentiality steps likewise protect delicate monetary information, which can be essential for maintaining affordable advantages. In general, using OFCs can create an extra reliable financial framework, sustaining both functional effectiveness and critical business purposes in a worldwide context.

Difficulties in Conformity

Another major obstacle is the advancing nature of global policies targeted at combating tax obligation evasion and cash laundering. As governments tighten analysis and rise reporting demands, companies need to stay agile and informed to prevent fines. This demands recurring financial investment in conformity sources and training, which can strain functional spending plans, especially for smaller enterprises.

Additionally, the assumption of OFCs can produce reputational threats. Eventually, companies have to meticulously browse these difficulties to make sure both compliance and sustainability in their worldwide procedures.

Regulatory Trends Impacting OFCs

Recent regulatory patterns are significantly reshaping the landscape of overseas money centres (OFCs), engaging services to adapt to an increasingly rigorous compliance atmosphere. Governments and global organizations are applying robust procedures to enhance openness and battle tax evasion. This shift has actually resulted in the fostering of campaigns view such as the Typical Reporting Criterion (CRS) and the Foreign Account Tax Obligation Conformity Act (FATCA), which need OFCs to report financial details about foreign account holders to their home territories.

As compliance expenses rise and regulatory scrutiny increases, businesses utilizing OFCs have to browse these modifications meticulously. Failing to adapt could cause serious fines and reputational damages, underscoring the value of positive conformity methods in the evolving landscape of offshore Our site finance.

Future of Offshore Money Centres

The future of overseas finance centres (OFCs) is poised for substantial change as progressing governing landscapes and shifting worldwide economic dynamics improve their role in international organization. Enhancing stress for openness and compliance will challenge traditional OFC versions, triggering a change towards greater liability and adherence to worldwide standards.

The fostering of electronic innovations, consisting of blockchain and artificial intelligence, is expected to redefine exactly how OFCs run. These developments may improve operational effectiveness and enhance compliance systems, enabling OFCs to provide more protected and clear services. As global investors look for jurisdictions that prioritize sustainability and business social duty, OFCs will require to adapt by embracing sustainable finance principles.

In feedback to these trends, some OFCs are expanding their solution offerings, moving beyond tax optimization to consist of wealth management, fintech options, and advisory solutions that line up with global best practices. As OFCs progress, they have to stabilize the demand for competitive benefits with the requirement to comply with tightening policies. This dual emphasis will eventually determine their sustainability and importance in the worldwide organization landscape, ensuring they remain essential to international economic procedures while additionally being liable company residents.

Verdict

The impact of Offshore Money Centres on international company procedures is extensive, using countless benefits such as tax performances and streamlined processes. The boosting complexity of conformity demands and heightened regulative scrutiny existing substantial difficulties. As worldwide requirements advance, the operational landscape for organizations making use of OFCs is changing, demanding a calculated approach to make sure adherence. The future of Offshore Money Centres will likely depend upon balancing their integral advantages with the demands for better openness and liability.

Offshore Money Centres (OFCs) have actually become pivotal in shaping global company procedures, using unique benefits such as tax obligation optimization and regulative flexibility.Offshore financing centres (OFCs) offer as essential centers in the worldwide financial landscape, helping with worldwide company deals and investment opportunities. Generally, the usage of OFCs can develop an extra effective economic structure, sustaining both operational performance and critical service purposes in a worldwide context.

Browsing the complexities of conformity in offshore financing centres (OFCs) presents significant obstacles for organizations.Current governing fads are considerably reshaping the landscape of offshore money centres (OFCs), engaging businesses to adapt to an increasingly stringent conformity environment.

Report this page